Subscriptions, auto-renewals and payments clauses in a Terms and Conditions agreement all work to outline how these features work, and how you expect payment for them.

Let's break down what you need to know about these clauses and how you can create and display them in your own Terms agreement.

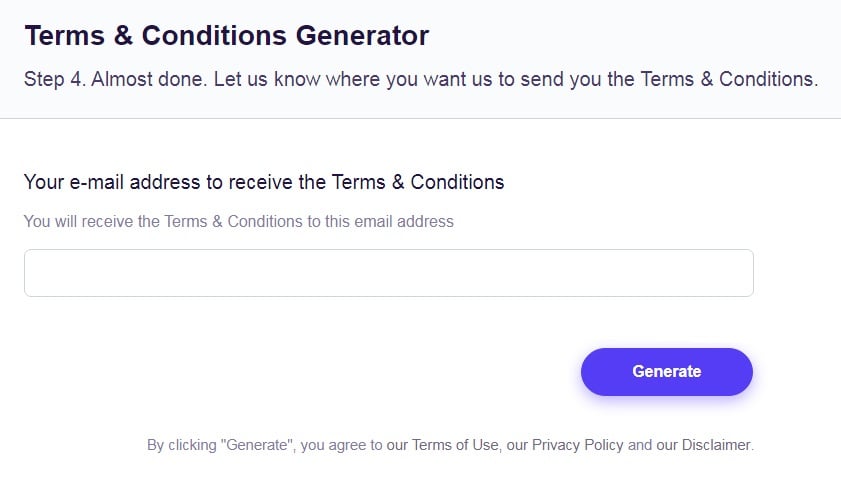

Our Free Terms and Conditions Generator is created to help you generate a professionally drafted agreement that can include various terms and conditions for your site and/or app.

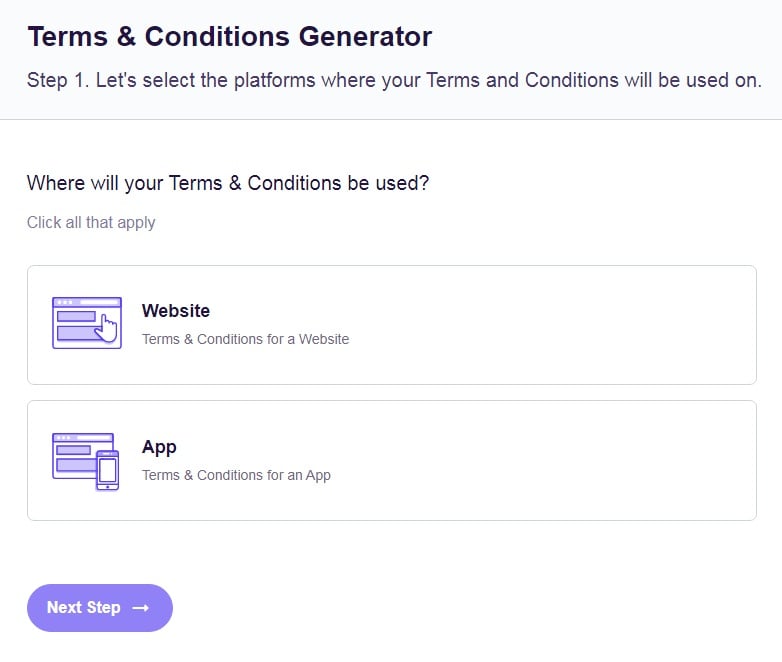

- Start the Free Terms and Conditions Generator from our website.

- Select platforms where your Terms and Conditions will be used (website, app or both):

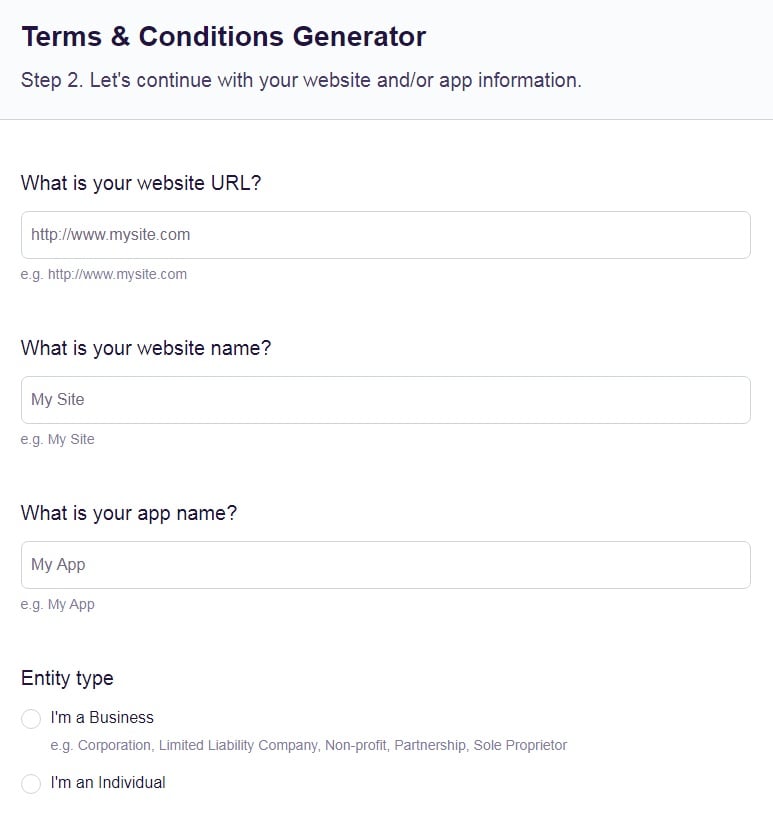

- Answer a few questions about your website or app information:

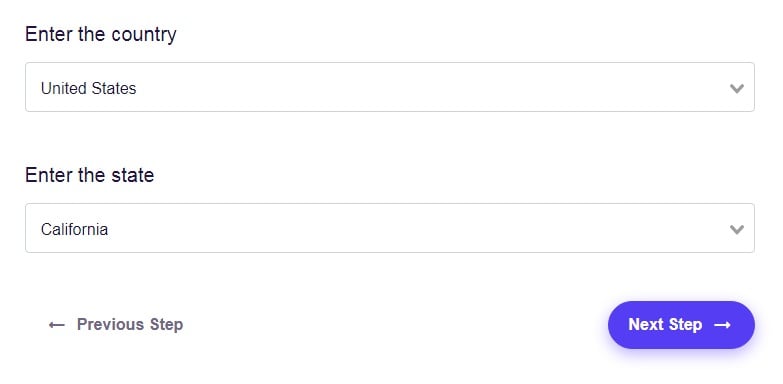

- Select the country:

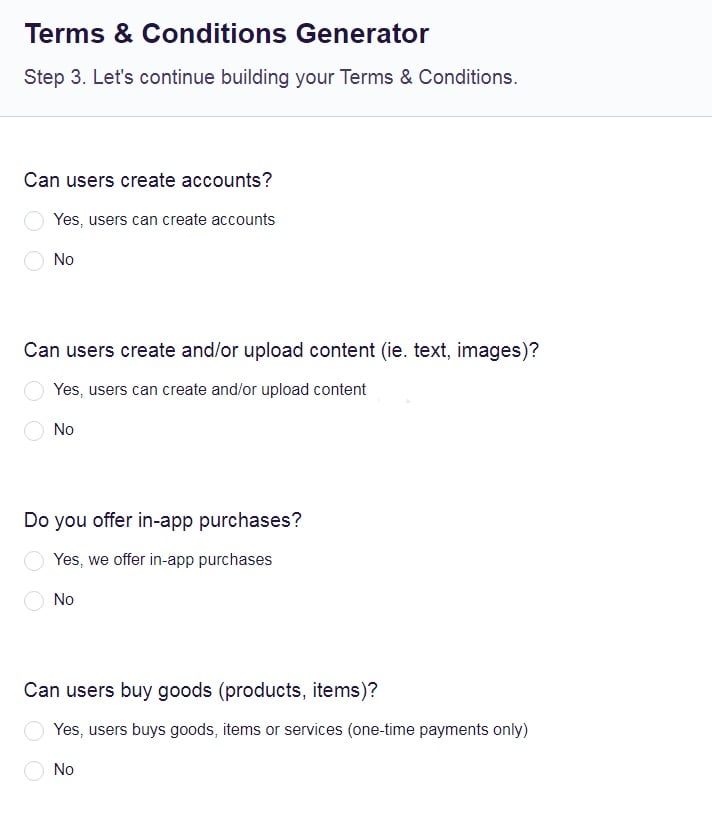

- Answer a few questions about your business practices:

-

Enter your email address where you'd like to receive the new Free Terms and Conditions and click "Generate":

Once generated, you can copy and paste your Free Terms and Conditions agreement on your website or app or link to your hosted Free Terms and Conditions page.

- 1. What are Subscriptions, Auto-Renewals and Payments Clauses?

- 2. Key Points to Address in Subscriptions, Auto-Renewals and Payments Clauses

- 3. Legal Requirements

- 4. The Privacy Law Element

- 4.1. General Data Protection Regulation (GDPR)

- 4.2. California Consumer Privacy Act (CCPA)

- 4.3. Virginia Consumer Data Protection Act (CDPA)

- 4.4. Personal Information Protection And Electronic Documents Act (PIPEDA)

- 5. What to Include in Subscription and Auto-Renewal Clauses

- 5.1. Renewal Date and Cost

- 5.2. Reminders of Auto-Renewals

- 5.3. How to Cancel

- 5.4. Your Own Rights

- 6. How to Present Subscription and Auto-Renewal Clauses

- 7. Summary

What are Subscriptions, Auto-Renewals and Payments Clauses?

These clauses in consumer contracts, Terms and Conditions agreements and other related documents cover your legal agreement with a customer to take payments in the future.

They go beyond the traditional basic contract that covers a single exchange of money for a product or service, even if the payment or delivery will come later or if the payment is in instalments.

The key here is that you and the customer are agreeing that you will make future exchanges of money for goods or services. In most cases, these exchanges will happen at regular intervals until one of you cancels the agreement.

Examples of such agreements include:

- An online streaming service that charges a monthly fee

- A coffee roaster who sends a bag of coffee to a customer every second week

- A security software tool where customers pay an annual access charge

In many cases, such agreements begin with an initial period or delivery which is either free of charge or at a reduced fee. If the customer doesn't cancel during an "introductory" or "trial" period, the business continues providing the goods or service at the full price.

Key Points to Address in Subscriptions, Auto-Renewals and Payments Clauses

Depending on your specific business model, some common points to address include:

- When (and how often) they'll be liable for further payments

- What they get in return for the payments

- Whether and how the amount they pay will change

- How and when they can end the agreement and thus not be liable for any further payments

- How and when you can end the agreement

Legal Requirements

Several laws around the world govern how you can use subscriptions and auto-renewals or what information you must give to people.

The Michigan Bar Journal noted that in the U.S., most courts consider such clauses legally enforceable as long as they use clear and unambiguous language. Some states have specific laws that detail particular elements that must be included in such clauses.

For example, California says the information must be "clear and conspicuous," listed near the signature line, and made prominent through a larger font size or contrasting color to surrounding text.

Meanwhile, New York also has a "clear and conspicuous" requirement and says businesses must notify customers 15 to 30 days before a renewal is due.

The United Kingdom's law says some consumer contract terms deemed "unfair" are unenforceable. It says renewal terms are more likely to be considered fair if they give clear information about how renewal happens and how to stop the renewal, and if the contract binds the seller to remind the customer of an impending renewal.

"Unfair" terms could include requiring too much notice to cancel an agreement, giving too little warning, or imposing financial penalties.

Australian courts have ruled that automatic renewal clauses are legally enforceable as long as they do not create a significant imbalance between supplier and customer.

Of course, what you tell customers isn't just about complying with laws. Giving clear information in Terms and Conditions agreements and other documents will build trust and improve the chances of benefitting from positive word of mouth.

That's particularly true in industries where some less ethical businesses deliberately try to exploit confusion and a lack of clarity to collect money from customers who weren't expecting to make the payment.

The Privacy Law Element

You might think that privacy and personal data laws have no connection to subscriptions and auto-renewals. After all, such payment models are all about a commercial transaction of money for goods and services rather than about personal data. In reality, the two are often strongly, if indirectly, connected. That's because processing a customer's subscription or renewal payment often involves personal data.

This could be:

- Their name and address for shipping a product

- Their payment card or bank account details

- The email address for confirming a renewal or as a username for online access and account identification

- Their choice of product or service, which could be personal information in itself or combined with other data for profiling.

This is all important because many personal data laws rely on consent and/or awareness to make processing lawful. If you can't show for certain that a customer was expecting a repeat payment, you may struggle to prove they consented to the data processing that you carried out when taking that payment.

Let's run through some laws where this may be an issue.

General Data Protection Regulation (GDPR)

The GDPR, which covers data processing in the European Union, says you must have a lawful basis to process data. The two most relevant options for businesses are consent and legitimate interests.

The legitimate interests basis usually only applies if a customer could reasonably expect you to process data in a particular way. Clearly this isn't the case where the processing is for a payment they didn't expect.

California Consumer Privacy Act (CCPA)

The CCPA, which covers many large businesses serving California consumers, doesn't require advance consent to process personal data. However, it does establish and enforce a legal right for consumers to know about any processing.

Your Privacy Policy and related documents will need to make clear that you could use their personal data for future payments and when they will happen.

Virginia Consumer Data Protection Act (CDPA)

The CDPA, which covers many businesses serving a large number of Virginia consumers, gives consumers the right to know how you process their data.

Personal Information Protection And Electronic Documents Act (PIPEDA)

PIPEDA, which applies to many Canadian businesses, requires meaningful consent before you process personal data. In other words, the customer must understand the consequences of giving consent.

What to Include in Subscription and Auto-Renewal Clauses

Exactly what to include may depend on the laws in your jurisdiction and the specific offer you want to make to potential customers. Regardless of what you must do legally, the more of these points you cover, the more trust you will build with customers.

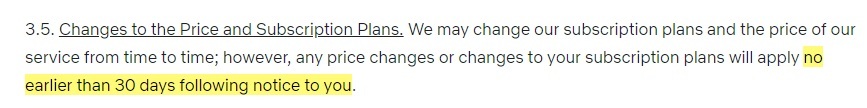

Renewal Date and Cost

Explain how often and when you will take payments. This could be specific dates or at specific intervals after the initial payment.

Explain whether the price for future payments will remain the same or if you have the right to increase it. Explain how you will tell customers about a price increase.

Netflix explains how users will get advance notice of a price increase:

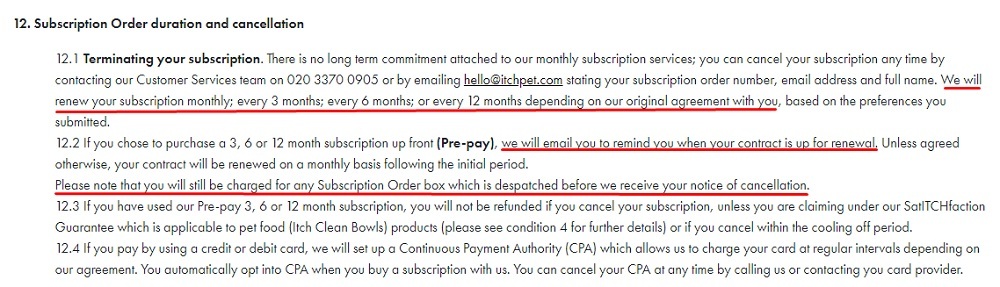

Reminders of Auto-Renewals

You should have a clear policy saying if and when you will send a reminder about an upcoming renewal payment, plus the method for sending it. You may want to cover the customer's responsibility for making sure you have their correct contact details, such as a current credit card on file.

The reminder should be early enough that the customer has a realistic and practical opportunity to cancel the agreement and prevent future payments. This is particularly important if you have any minimum notice period.

Covering all these points in the renewal clause will make it binding on you. For most ethical businesses, this should not be a problem.

Itch commits to reminding customers about renewal payments. Though it doesn't give a precise timescale, customers could reasonably expect this would be in enough time to cancel before the next subscription box is despatched and they are charged:

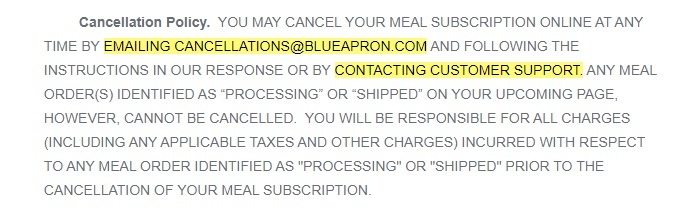

How to Cancel

Tell the customer how they can exercise their right to cancel the agreement and prevent future payments. This should include what they must say and how they must contact you.

You can reduce the risk of a clause being declared invalid or legally unfair by not intentionally making it harder for the customer to cancel. For example, saying the customer has to deliver a cancellation request in person or by calling a premium-rate phone line could be classed as unfair.

Make sure to cover the consequences of cancellation. For example, tell the customer whether they will continue to get a service (such as access to a streaming site) until the next payment was due, or if it will cease as soon as they cancel:

Blue Apron clearly explains the process and consequences of cancelling:

Your Own Rights

Cover whether you have the right to alter the product or service you provide and whether this may require a price rise. Make sure you include the right to cancel the agreement yourself and stop supplying the product or service.

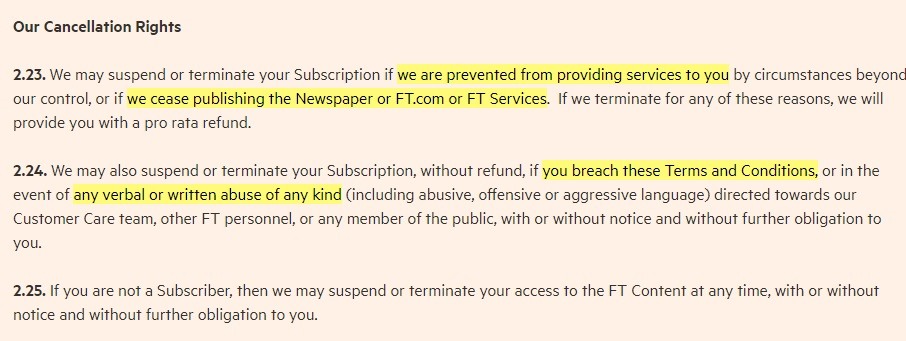

The Financial Times details how it can cancel a subscription:

Now that you know what information to include in these types of clauses, let's look at how to make this information available to your users.

How to Present Subscription and Auto-Renewal Clauses

The following guidelines will build trust with customers and reduce the risk that you are accused of acting unfairly:

- Present the clauses alongside other key information such as the initial purchase price. Don't put it in a less prominent place, for example as a footnote.

- Make certain the customer has a reasonable opportunity to read the clause before signing up to a contract.

- Do not downplay or hide the information, for example by using a smaller type size or a less prominent color.

You should have a Terms and Conditions agreement which customers must acknowledge and agree to before starting a contract. This is a perfect place to include this type of clause.

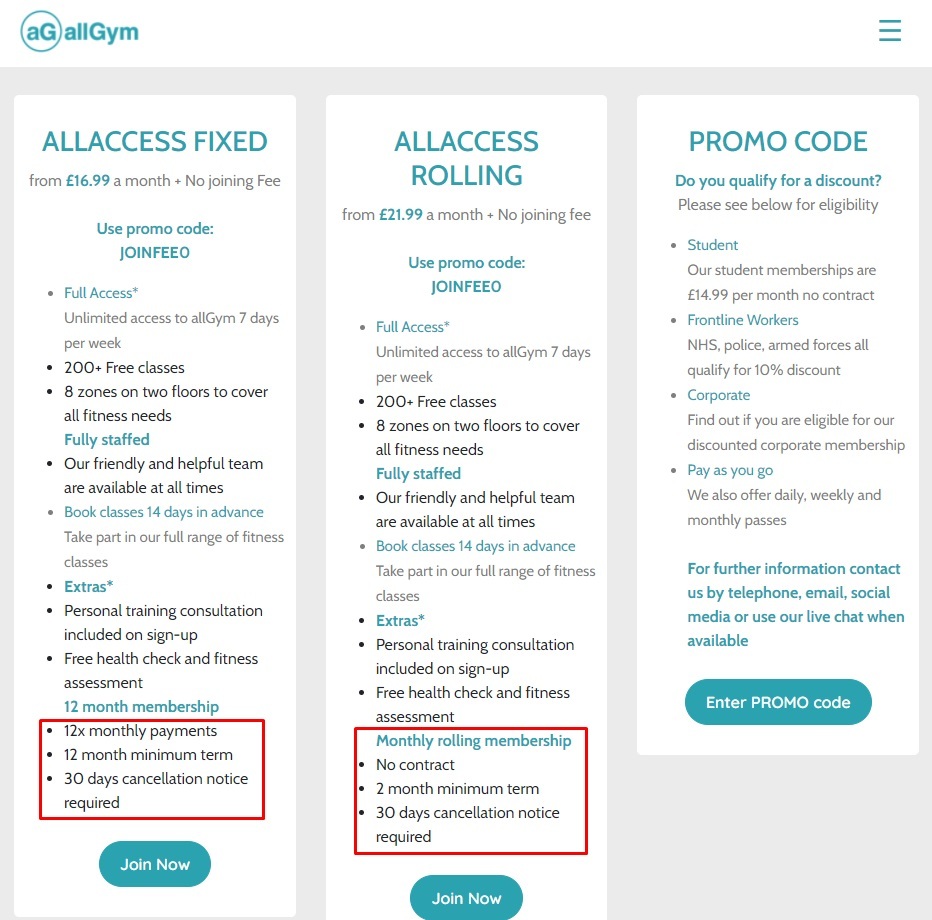

In addition, you can include this information explicitly on your website at points both before and during the signup process, like AllGym does here:

Summary

Let's recap what you need to know about subscriptions, auto-renewals and payments clauses:

- These clauses cover business models where you take regular payments from a customer, for example for a subscription service. They sometimes follow a cheap or free introductory period.

- Several national and local laws say such agreements are only enforceable where the relevant clauses are clear and adequately prominent. Some also say they must not be unfair or one-sided.

- Most privacy laws don't directly cover such clauses. However, many privacy laws require consent by informed customers to process personal data, while others say people must know how their data is used. Operating such a business model and taking future payments will almost always involve processing personal data.

-

Such clauses should include:

- Renewal dates and schedule

- Renewal price and potential rises

- When and how you remind customers about upcoming payments

- How you or the customer can cancel the agreement

-

Such clauses should be presented:

- With at least as much prominence as other parts of the agreement

- Before the customer signs up to any commitment.